Display this:

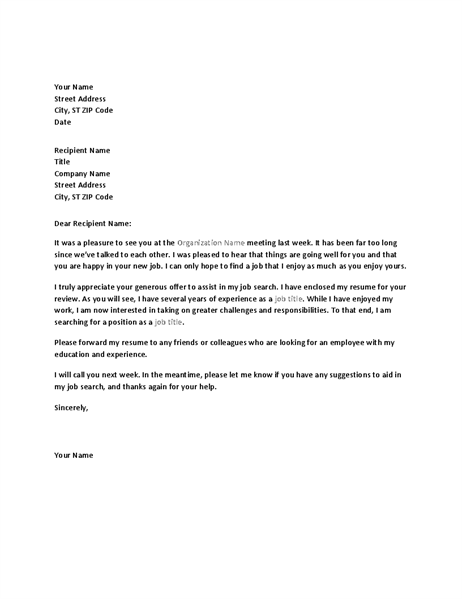

Rodrigo Mendoza, thirty-two, recently realized he had been pre-acknowledged getting a property financing but their plans to individual a great home are on keep since DACA is being repealed during the Temecula Wednesday, . (Honest Bellino, The latest Press-Enterprise/SCNG)

Rodrigo Mendoza, 32, (center) enjoys dinner on his family home for the Temecula, Mendoza recently revealed he had been pre-recognized for property mortgage but their intends to own an effective family take keep since DACA has been repealed. Wednesday, . (Honest Bellino, The newest Push-Enterprise/SCNG)

Rodrigo Mendoza, thirty-two, has just found out he was pre-approved for a home mortgage however, his intentions to own a household take hold given that DACA has been repealed when you look at the Temecula Wednesday, . (Honest Bellino, Brand new Press-Enterprise/SCNG)

Rodrigo Mendoza worked complete-big date because the a pipe layer getting few years, enough to build his borrowing to invest in his first domestic.

Mendoza, thirty two, off Temecula, is an associate about Deferred Action to own Childhood Arrivals, or DACA, system that has offered one or two-seasons sustainable functions it permits and you can deportation rescue in order to regarding 800,000 young immigrants across the country.

Brand new Obama-day and age system, because the announced Sept. 5, could be phased out within the next half a year, interrupting tomorrow plans regarding Mendoza and other DACA recipients who have made financial strides around this program.

Which was certainly one of my biggest aspirations, to invest in my domestic, Mendoza said. Leggi tutto “Home ownership would have to wait for that it DACA individual”