- The price of the house

- This new down payment count

- The borrowed funds identity (the size of the loan)

- The potential home loan rate of interest

- The amount of possessions fees due per year toward assets

- Brand new estimated cost of home insurance

- Any additional costs, particularly property owners connection (HOA) charge or PMI

Consumers also can pick a large financial company to enable them to store doing and acquire an educated fit for them, otherwise they can read home loan company reviews on the web to see which of these will be a good fit

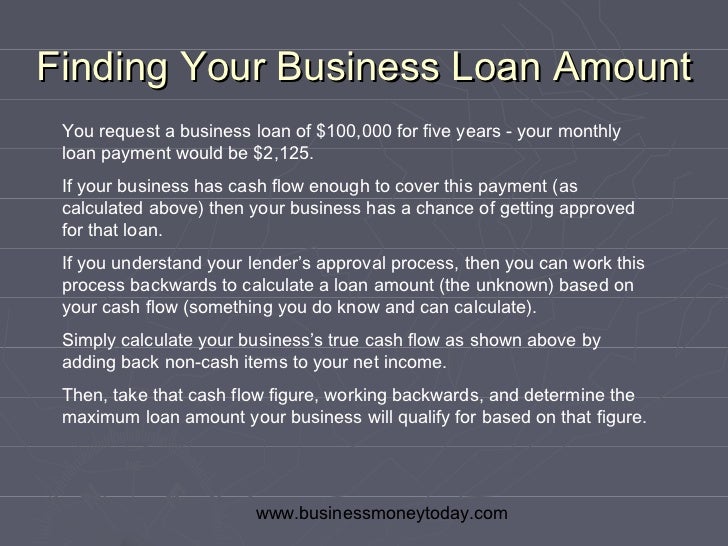

Since the client gets in this particular article to the home loan calculator, they are capable of seeing their estimated monthly payment. Capable following fuss into amounts to find out if they may be able pay for increased home loan, lower down payment, otherwise shorter financing identity predicated on its current financial climate. This informative article will assist all of them regulate how far mortgage they’re able to be able to deal with, that assist them to come across a home that will fit into the budget without overwhelming their profit.

2nd, our home client would want to think about the different types of mortgages and determine and that financing they want to submit an application for. Leggi tutto “Step 3: Know your loan solutions and you can consider different varieties of loan providers”