Sure, most definitely, nevertheless have to be much of your residence. Eligible possessions types are: solitary household members home, 1-cuatro Product attributes, specific were created house, condos and you may townhouses. Newly built attributes must have a certification away from occupancy ahead of an excellent loan application can be taken. For lots more certain guidance, delight contact your regional Every California Opposite Home loan Professional.

A reverse home loan my work better for you while a elderly who’s wanting bucks and you have extremely of your websites worthy of fastened in home equity. Yet not, knowing the the inner workings ones loans and you will evaluating the associated can cost you is extremely important because they don’t functions as well for all. Instance, when you are a reverse home loan can help safe your retirement, losing your home in order to foreclosures are a chance if you’re not careful together with your funds.

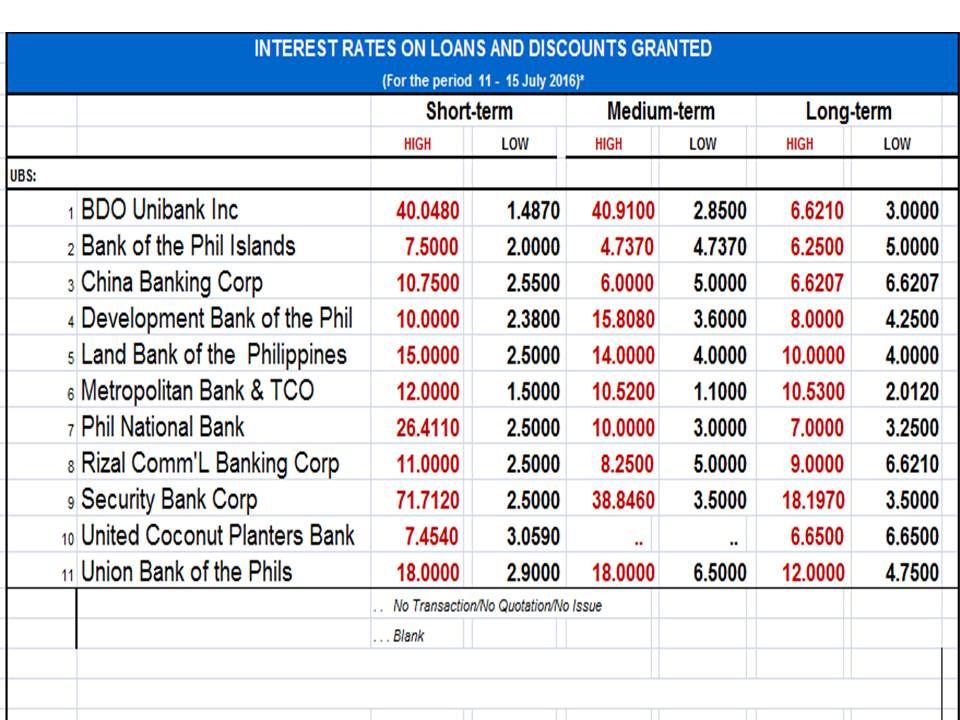

Quantity Speak

A news release shared from National Opposite Lenders Connection website highlights the casing useful the elderly (62 years and you may old) expanded from the $520 million or 4.91% in the 1st quarter of 2022 when compared to the 4th one-fourth from 2021. Additionally, it touched a record high of $ trillion. The production suggests that a portion of the driver at the rear of it go up try a rise in home prices by to $563 million or 4.4%, with a beneficial $43 billion or 2.09% rise in the debt one older people hold working as a beneficial compensating factor.

Investigation released of the Statista reveals the fresh origination greater than 44,000 house collateral conversion process mortgage loans (HECM) in america inside the 2021. Leggi tutto “Opposite Mortgage loans and you can Everything you need to Realize about All of them”