Whether you’re thinking of buying a mobile family, were created household, or standard domestic now otherwise afterwards later, you want to make it easier to know very well what this new to get process appears for example.

These house are perfect for those exactly who try budget-inclined, interested in a beginner home, downsizing, looking for a farm otherwise river assets, if you don’t an invitees house. With regards to to invest in a cellular, manufactured, otherwise modular domestic, the procedure is a little distinct from to purchase an earlier online installment loans Pennsylvania created single-family home otherwise townhome. Inside publication we’ll see just what which home buying process turns out of the cracking it on to around three parts:

- Five Methods you ought to Over at your home To purchase Techniques

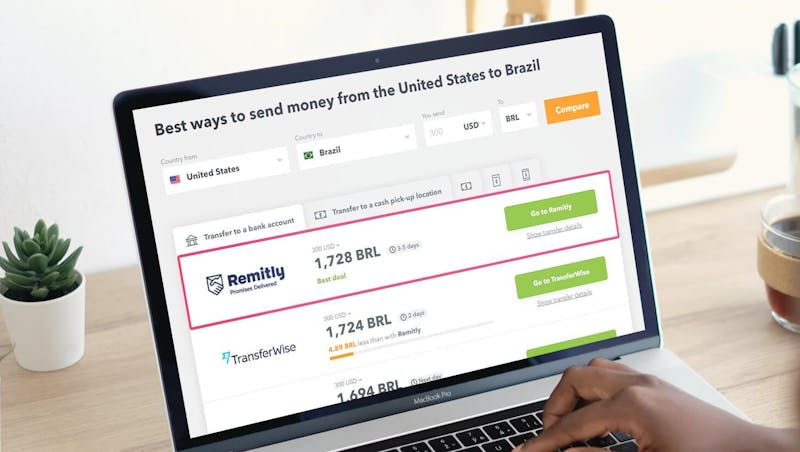

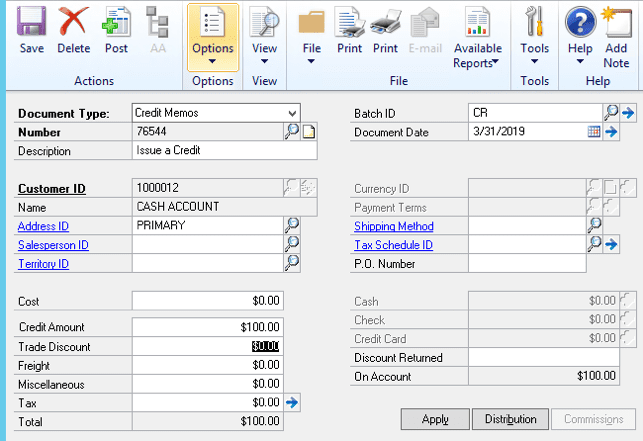

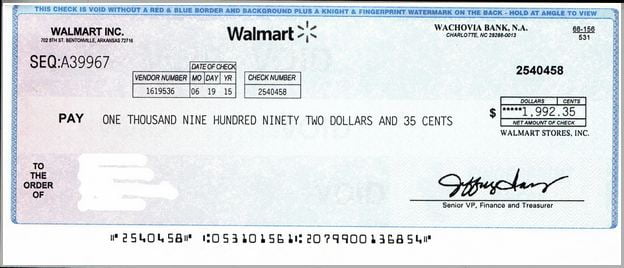

- Money Factors

- Household Website Options and you may Family Site Preparing

Influence your Family’s Need

Have a notable idea of some standard have you want. Exactly how many bedrooms and you may restrooms? Most cellular homes now all the have about dos complete restrooms. Would you like a living room and living room or a more impressive “living room”? What would you think of as the key area for you on the brand new home? Were there unique needs otherwise considerations such as for example furniture size, rooms size, special requires, an such like.?

Influence a spending budget

Usually lenders play with a spending plan calculator to determine what the payment capabilities try. You can find multiple apps on the internet to assist you carry out that. A general rule of thumb is the fact your monthly payment tend to be on .8 -1% of one’s number you obtain. Leggi tutto “Cellular, Were created, & Standard Property Techniques: A complete Book”