Hence, considering the task of your payment arrangement so you can Green Tree, they retains an equivalent liberties, advantages, and you will remedies you to definitely Johnson Mobile Homes kept under the cost contract

Data “An immediate focus ‘s the correct process which to look for summary of a trial court’s purchase doubting a movement to force arbitration.[] Discover House out of Legend, Inc. v. McCollough, 776 Thus. 2d 741 (Ala.2000). Which Judge critiques de- novo a try court’s assertion out of an effective motion so you can compel arbitration. Id. from the 745.”

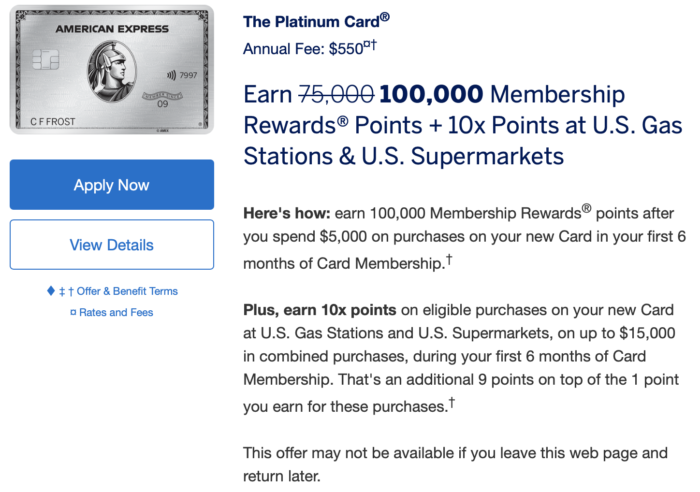

1st, we remember that since Eco-friendly Tree seeks in order to force arbitration from this new Channells’ states, it’s got the duty regarding demonstrating the presence of an agreement calling for arbitration and you can proving you to definitely one to offer indications a deal one dramatically impacts interstate commerce. Leggi tutto “Concurrently, brand new Channells sent the installments to help you Environmentally friendly Forest at the an address during the Louisville, Kentucky”