Paying for a small family initial from inside the cash is naturally brand new best method off resource. If you’re able to slip a suitcase laden with dollars along side dining table, there is nothing to be concerned about money and you can rates.

If you’re looking to spend faster finally and you can prevent the danger of taking out fully loans, this option helps to make the very sense.

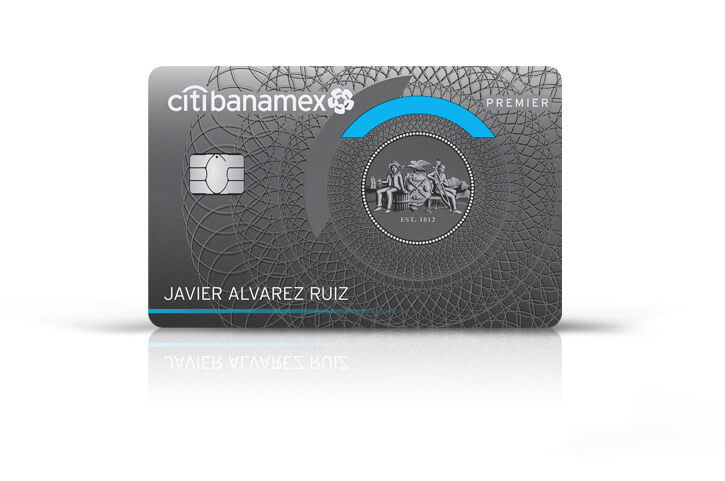

What about handmade cards?

Commercially you can fees the price of your own lightweight home to a charge card, however, this option gets the bad installment words and we also are unable to strongly recommend they.

First and foremost, you might need to have a top adequate harmony to afford price of their smaller home, that is tough unless you be satisfied with more low priced one.

Smaller homes was charming and sensible choices to help you traditional houses, but there are numerous details you have to know before you could dive when you look at the which have each other legs.

Need the spot to construct to the

When it sleeps towards the a long-term basis or perhaps not, you want homes to suit your lightweight domestic. Although residential property isn’t free thus you’ll must money a plot of land also – that is if you aren’t strengthening they towards the a preexisting assets.

Wanting resource having underdeveloped homes are going to be problematic, as well as if you find a getting a va personal loan method to shell out the dough, you need to envision local statutes.

Zoning laws and regulations will get stand-in the way anywhere between what you’re invited to build towards the house plus plans into smaller domestic.

In addition to, if the there aren’t any readily available tools toward parcel you have chosen, you want a relationship having liquid and strength.

Resale value is typically lowest

A primary reason why lenders could possibly get will not loans tiny homes is because they has actually a minimal return on the investment.

Of numerous tiny households are designed on tires and additionally they depreciate into the a comparable solution to cars and you can RVs. Other than that, deterioration along with restoration is another situation one adds up will set you back pertaining to to buy a little house.

Regardless of where you earn financing or otherwise not, make fully sure you get a good seller’s assets disclosure prior to making your purchase to ensure all of the problems are taken into account. If you have destroy, you will be capable of getting the home to have minimal.

Need one thing to disperse they that have

In case your small domestic is not built on a permanent basis and you can you want to move around in it, needed a bigger vehicles like a trailer to pull it with the next destination.

On the other hand, you might take your domestic nearly everywhere all over the country. Therefore in a way, you get a cellular lives and liberty in exchange for the prices of this swinging the house round the long ranges having a great large vehicle.

You can not playground they anywhere

You could potentially put your little house to the a lot and never flow they, or incorporate cellular life and make use of your lightweight domestic as the an enthusiastic Rv or rv.

Of many campsites and trailer parks allow you to playground on their cause of a lengthy period of time, that is ideal for tiny property owners.

Likewise, particular campgrounds commonly turn small homes out, so that you ideal would search with the where you stand allowed to stand. Also, being at campsites and you can areas relates to each and every day, a week, otherwise monthly payments, that can easily be higher priced than just leasing a flat – based on your local area and you can length of remain.

When you are thinking about leasing your own tiny household, you could consider a corporate mortgage which can have other conditions. Well-known banking companies constantly usually do not highlight little mortgage loans, however you nevertheless may be able to have one, especially if you enjoys a good credit score.