Large financial company payment costs start around lender-to-financial. As Lenders basically does the work regarding a good banker, lenders are content to invest a percentage in exchange for an excellent winning application for the loan meaning the consumer does not have any to blow them things. There are two ways a large financial company will get paid off: initial percentage and you will walk percentage.

All of our percentage cost for your financing will always be unveiled upfront getting every lender recommendations within Mortgage Guidance PDF & once again within our Borrowing Proposition in advance of entry. That it revelation is designed to assist give you peace of mind – hopefully you never thought we had swindle you anyway, but simply if is an issue, Bluish Fox Funds has arrived in order to guarantee you one to the audience is certified with legislation which might be in position to safeguard customers of any unseemly measures.

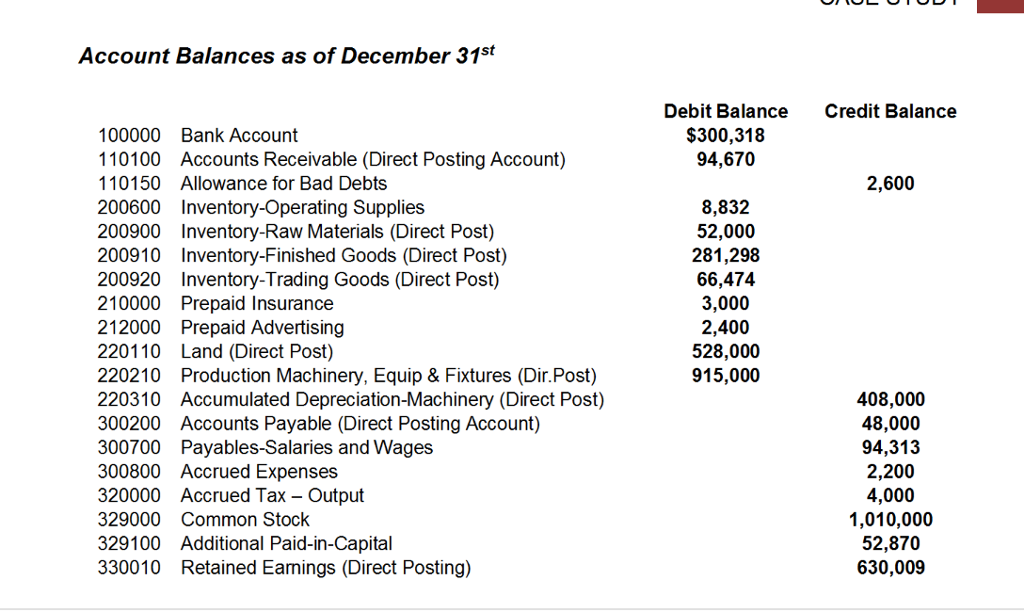

You will find a complete range of the lenders’ fee rates on our Remuneration Revelation, you can also select a for all the cost of some prominent loan providers below:

Clearly, though money is unregulated, the essential difference between banking institutions commission rates is quite limited. Whenever you are earnings may appear in order to remind bias, this design is what allows Mortgage brokers to incorporate the qualities to the customer, instead battery charging all of them. And if you are concerned with even if we’re going to take higher profits out of businesses that maybe doesn’t efforts along with your most useful passions – do not! Your own sense being a is far more vital that you us as good word of mouth is when we due to the fact Mortgage brokers rating paid back!

Upfront Payment

It is a single-time commission paid off about thirty day period shortly after settlement. A mortgage broker is required to reveal the percentage in order to your inside process. Whilst rate differs from financial to help you financial, widely known initial commission rates are 0.65% – 0.70% + GST. New upfront fee is not paid back of the customer in almost any method.

Some banks have implemented a system whereby the upfront commission is calculated as the new loan balance less any offset account balances.

Clawback out-of Initial Profits

In the event the a customers will pay away or refinances their home loan inside couple of years, a loan provider is demand an effective Clawback condition upon a mortgage broker, forcing the new Broker to pay straight back their initial payment. While this upsets many Lenders, it will are employed in the newest favour of one’s customer, ensuring the loan Agent leaves the loan with a lender you to you will be proud of, otherwise they will have to pay the fee back.

Of many banks has actually has just delivered a ‘partial clawback’ in which might clawback brand new payment for all the swelling-sum money made for the first 12 months.

Path Percentage

Walk Payment is an additional system to be sure a mortgage broker sets the client which have a financial they will be pleased with. Every month your customers stays with the same lender, the new launching Large financial company gets paid off a little payment (extent usually increases slow along side first 5 years). Such money avoid when a customer will pay out the financing, otherwise refinances using yet another financial or Large financial company. This is why it’s very crucial that you us at the Bluish Fox Fund to create and sustain all of our dating with the clients. Many out-of demo fee are making sure the continued satisfaction with the loan brokerage features, as it myself outcomes all of our feature as lenders to locate reduced. There is no doubt one to we’re going to do everything in our stamina to be sure the better ongoing bargain to you along with your mortgage, as it facilitate not just you but all of us too to help you get it done. Call us right now to discover more about whatever you will do for your requirements.

This trailing amount is paid to cover the Broker’s ongoing costs of maintaining your loan. For us, that includes an yearly price remark, loan restructuring, loan increases & refinances.