Providing pre-recognized for the home loan is a big 1st step. It is generally telling you that one can pay for property. Its an atomic bomb on the repertoire and you will allows vendors and you can agents remember that you’re significant. Although not, this is not the conclusion debt files, and doesn’t mean which you have everything safer. There are a great amount of difficulties to get over. Listed below are 8 things to bear in mind for the reason that months between pre-acceptance and signing the very last data

Maintain your Vehicle Unless you Relocate

Listed here is a term you will listen to A great deal during the this short article. DEBT-TO-Money Proportion. This really is probably one of the most keys to save within the head in the entire process from trying to get your home. Make certain you dont increase the amount of personal debt as to what you have, otherwise it leads to warning flag during the procedure. We will run their borrowing during your software, but we’re going to including glance at once more prior to we settle, to make certain that little radical have occurred. If you purchase another vehicles and you will add loads of personal debt for you personally, it can skew your borrowing from the bank and you will force us to need to evolve the borrowed funds. Wait until once you sign on the fresh dotted range, guys.

Cannot Start You to The brand new Work Yet ,

Something that mortgage companies eg all of us choose to come across is actually Stability. We need to know that youre place in your job and you may are not planning to maneuver around, since we truly need one pay back your own financial. Certainty on the condition is a significant factor in their mortgage, just in case you unexpectedly button careers, or start a separate company, your own investment things transform, therefore need readjust your application to complement they. This can end up in your own interest levels to alter as the trust into the what you can do to settle the loan may fall off.

Continue One to Regular Income

This really is an identical reasoning. Although you’re make more money instantly, an alternative, heavily-accredited work scares financial people. Heading regarding an ensured income to one where you are able to generate very more wide variety monthly is actually an enjoy, rather than one that mortgage people want to rating sprung to the them just after obtained currently viewed your constant income.

Allow your Money Accept

Let your money accept. Finance companies and mortgage organizations do not like observe your finances moving around after we agree you to have home financing. It doesn’t motivate trust observe several thousand dollars gone to. The financial institution will even often be sure your cash supplies to make sure that one may afford the closing costs of the mortgage therefore keep your money where its.

Keep the Expense Latest

Even if you is disputing a bill, spend they if it’s gonna become a later part of the commission or some other strike against your own borrowing from the bank. These are borrowing poison, and we’ll see them whenever we create our check through to the final recognition of your own financial. Your own home loan was a continuously altering amount that really must be monitored. Don’t let an adverse statement keep you from your own dream domestic!

We get it. You might be getting into your new family and you want to have everything you ready to relocate. You should never do it! Whether or not you’re score a knowledgeable price actually by the completing credit cards to purchase your chairs and you can products, even more loans is far more obligations! You ought to maintain your Loans so you can Earnings Proportion once the lower that one can regarding the app procedure. Whether it change substantially we need to reassess your credit score also it can apply to one last application.

Complete The Current Papers

Many parents offer a gift to their people to make their earliest down-payment to their property. However, this might be an asset that has to be logged and taxed securely. Discover other laws and regulations for how the off payments for each and every types of loan may be used.

Old-fashioned

- For those who lay out 20% or higher, it does be out-of a gift.

- For loans in Kennedy Alabama many who establish lower than 20%, an element of the money should be a gift, however, part need to are from your own fund. So it lowest sum may vary by loan style of.

FHA and you can Va

If the credit rating are anywhere between 580 and 619, about step three.5% of your own down-payment have to be the money.

You additionally will want new gifter to transmit a present Letter a page discussing that money is a present and never a loan. You really need to have them to become:

- The brand new donor’s label, target and you will contact number

- New donor’s link to the client

- The new money amount of the fresh provide

- The go out the funds was indeed moved

- A statement on donor that no payment is anticipated

- Brand new donor’s signature

- The newest address of the home being ordered

Mortgage organizations would like to know in which your money is inspired by, so they determine if you may have any bills that may not appear on your credit history.

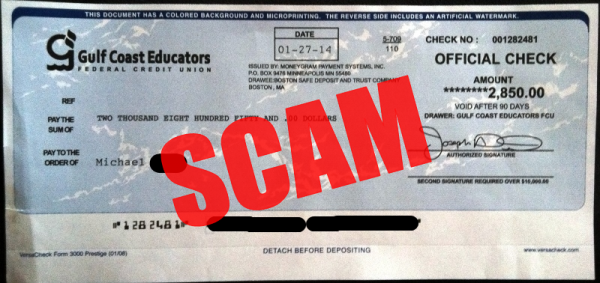

Remain Papers For all the Dumps

Should you choose get any money you ought to make certain it is reported very carefully. For many who offer your car or truck, receive a genetics, or victory the new lotto, that’s high! not, it must be noted properly. For many who sell a car or truck, you need about this new declaration from revenue. Having the ad you accustomed sell additionally the Kelly Bluish Guide to show the benefits dont hurt, either. For folks who acquired a cost regarding an old financial obligation, brand new terminated check may be sufficient, or a letter regarding payer may be needed. In case the organization doesn’t would direct deposit, be prepared to inform you see stubs for your paychecks. Why is that it very important? Because your financial would like to understand needless to say exactly what that money is. In case it is a loan, they’re going to learn. You need to be sincere, as concealing that loan from your lender is actually con.