Why Play with a good Heloc?

Property guarantee personal line of credit is a type of rotating borrowing in which the home is used as the security. As residence is likely to end up being the prominent house of a customers, of a lot residents play with their house guarantee to own biggest things such as for instance home improvements, education, otherwise medical expense in place of day-to-date expenses.

Which have a property guarantee credit line, the fresh borrower try permitted to acquire a certain number of borrowing from the bank. Although not, discover a borrowing limit that the bank establishes by taking a specific portion of the brand new house’s appraised worthy of and you can subtracting it on the existing mortgage’s balance. In the event that a borrower non-payments with the an additional home loan our home normally become forclosed through to.

Next tabs allows you to look for: how much borrowing from the bank you may also qualify for at multiple financing to help you really worth (LTV) range, just what monthly installments will be on your capital, and you may newest regional HELOC & family security financing rates.

Creditors loan to several limitations based on business criteria. Usually the restrict allowable LTV is in the 75% to 80% variety, however some creditors can get give as much as 100% to pick consumers with solid borrowing from the bank profiles.

After you have figured out your hard earned money aside limitation, then you’re able to consider how much cash we should supply & how you may want to repay it.

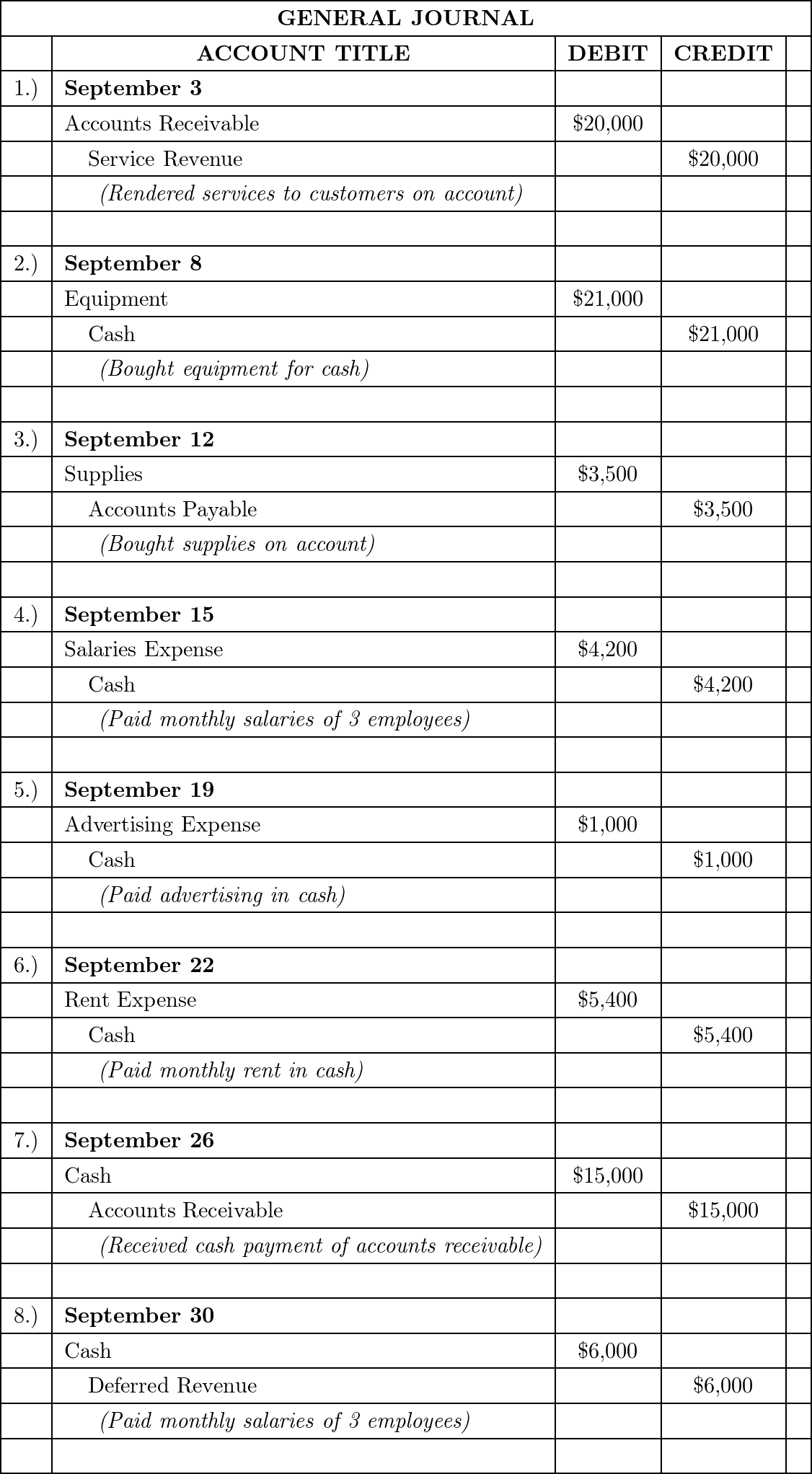

These amortizaiton tables let you know the eye will cost you and you may repayments more an effective 15-season schedule for a financial loan or personal line of credit that is fully burned on credit limit. The original column will likely be regarded as a predetermined-rate home equity mortgage or perhaps the cost ages of a HELOC in the event it uses a predetermined rate of interest when you look at the fees label. The following column are going to be regarded as new mark several months towards the an effective HELOC in which the resident was to make amortizing repayments, or the repayment months into the a HELOC if it still uses a changeable interest. The third line will likely be regarded as the latest draw several months to your a HELOC where homeowner is deciding to make the minimum monthly payment. HELOCs routinely have a draw age of up to 10 years and you will an installment ages of to 15 years beyond the draw several months. The latest cost several months would be both fixed or variable rates.

Homeowners: Influence Your home Guarantee Today

The speed dining table listings most recent domestic security now offers towards you, used to obtain a region lender otherwise compare up against most other mortgage choice. On the [financing method of] discover box you could choose between HELOCs and you may household guarantee finance from a good 5, 10, fifteen, 20 or 29 seasons cycle.

HELOC against Domestic Collateral Funds

Household guarantee loans are just like a classic compliant fixed-speed mortgage. They want a set monthly premiums https://paydayloancolorado.net/mount-crested-butte/ to have a fixed age time in which a borrower is actually borrowed a-flat sum of money upfront following will pay right back a specific amount each month for the remainder of the mortgage. Equity loans generally charge a somewhat higher initial speed than simply HELOC perform, however they are fixed fund in place of adjustable money. While replacing your roof and you may fixing the plumbing work and know precisely whatever they will definitely cost initial, up coming a property collateral mortgage could be a good fit.

HELOC provide better independence, including the ability to pay desire-simply for a time, right after which switch to a typical amortizing or balloon payment. When you have a good HELOC you are billed a small affordable annual commission – state $fifty to $100 – to save the latest line open, but you dont accrue interest unless you mark on the range. HELOC loans function better for those who is actually spending their child’s school costs every year or any other form of staggered periodic expenses. Be aware HELOC rates was adjustable and change just like the Government Put aside changes the fresh Provided Finance rates, thus monthly costs may jump notably for many who shift out-of attract-in order to amortizing payments around the exact same go out the fresh Federal Reserve really does a life threatening rate walk.